what insurance companies does allstate own is a question that many consumers and industry analysts ponder as they navigate the complex landscape of insurance providers. Allstate, known primarily for its auto and home insurance, has a diverse portfolio that extends beyond its flagship offerings. Understanding the companies under the Allstate umbrella can provide insights into their market strategies and the breadth of services available to clients.

This exploration will shed light on Allstate’s acquisitions, the types of insurance products they offer, and how these companies contribute to Allstate’s mission of protecting consumers and providing peace of mind. By examining these aspects, we can better appreciate the role of Allstate in the insurance industry and its influence on consumer choices.

In the ever-evolving realm of technology, the advent of artificial intelligence (AI) has sparked a significant transformation across various industries. From healthcare to finance, AI is reshaping the way businesses operate, creating efficiencies that were once unimaginable. This article delves into the intricacies of AI, exploring its applications, benefits, and the ethical considerations that accompany its widespread adoption.Artificial intelligence encompasses a range of technologies designed to simulate human behavior and cognitive functions.

These include machine learning, natural language processing, and robotics, among others. Machine learning, a subset of AI, enables systems to learn from data, improving their performance over time without being explicitly programmed. This capability is particularly useful in applications such as predictive analytics, where businesses can forecast trends based on historical data.One of the most prominent sectors benefiting from AI is healthcare.

With the ability to analyze vast amounts of data, AI can assist in diagnosing diseases, personalizing treatment plans, and predicting patient outcomes. For instance, AI algorithms can analyze medical images to detect anomalies, significantly reducing the time required for diagnosis. Moreover, AI-powered chatbots are being deployed in healthcare settings to provide immediate assistance to patients, answering their queries and guiding them through their healthcare journey.In the financial sector, AI is revolutionizing the way transactions are conducted and risks are assessed.

Financial institutions utilize AI for fraud detection, leveraging machine learning algorithms to identify unusual patterns in transaction data. This proactive approach not only protects customers but also enhances the overall security of financial systems. Furthermore, AI is transforming investment strategies through robo-advisors, which analyze market data and provide personalized investment recommendations based on individual risk tolerance and financial goals.Retail is another industry experiencing a significant transformation due to AI.

Retailers are harnessing AI to enhance customer experiences and optimize inventory management. Through data analysis, businesses can gain insights into consumer behavior, allowing them to tailor marketing strategies and improve product recommendations. AI-driven inventory management systems enable retailers to predict demand more accurately, reducing waste and ensuring that popular products are always in stock.While the benefits of AI are substantial, there are also ethical considerations that must be addressed as its adoption becomes more prevalent.

One primary concern revolves around job displacement. As AI systems become more capable, there is a growing fear that they will replace human jobs, leading to widespread unemployment. However, it is essential to recognize that AI will also create new job opportunities, particularly in fields related to AI development and maintenance.Another ethical consideration is the potential for bias in AI algorithms.

AI systems learn from historical data, which may contain biases that can be perpetuated in their decision-making processes. For example, if an AI system is trained on biased data related to hiring practices, it may inadvertently favor certain demographics over others. To mitigate this risk, it is crucial for organizations to implement fairness and accountability measures in their AI systems, ensuring that they operate transparently and inclusively.Data privacy is another pressing concern in the age of AI.

As businesses collect and analyze vast amounts of personal information, the potential for data breaches and misuse increases. Organizations must prioritize data security and comply with regulations to protect consumer information. Additionally, fostering trust with consumers is vital, as transparency in how their data is used can significantly impact their willingness to engage with AI technologies.As we look to the future, the potential of AI is boundless.

Continuous advancements in technology will enable even more sophisticated applications, transforming how we live and work. For instance, autonomous vehicles, driven by AI, promise to revolutionize transportation, reducing accidents and improving traffic efficiency. Similarly, AI’s role in climate modeling and environmental management could greatly enhance our efforts to combat climate change, leading to more sustainable practices.In conclusion, artificial intelligence is undoubtedly a game-changer in today’s digital landscape.

Its applications across various industries are reshaping the way we interact with technology and with one another. While the benefits are significant, it is essential to approach AI adoption with a mindful perspective, addressing ethical considerations and ensuring that technology serves humanity’s best interests. By fostering a culture of innovation, accountability, and inclusivity, we can harness the power of AI to create a brighter future for everyone.

As we navigate this rapidly evolving landscape, one thing remains clear: the journey of AI has only just begun, and its potential is limited only by our imagination and ethical commitment.

FAQ Resource

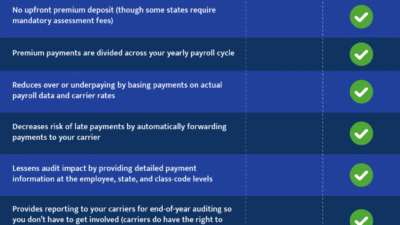

What types of insurance does Allstate offer?

Allstate offers a range of insurance products, including auto, home, renters, life, motorcycle, and business insurance.

How does Allstate rank among other insurance companies?

Allstate is typically ranked among the top insurance companies in the U.S. based on market share and customer satisfaction.

Are the companies Allstate owns independent?

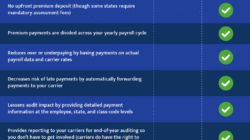

The companies owned by Allstate operate under its umbrella but may maintain some degree of operational independence in terms of branding and service offerings.

What is the benefit of Allstate owning multiple insurance companies?

Owning multiple insurance companies allows Allstate to diversify its product offerings, reach a broader customer base, and enhance its competitive edge in the market.

Does Allstate provide insurance in all U.S. states?

Yes, Allstate provides insurance coverage in all 50 U.S. states, offering a wide range of products tailored to regional needs.